Mastering Customs & Duty: Your Essential Guide

शेयर करना

Before you click “checkout” on that overseas print-lab order, remember that the courier van is only the last mile of a much journey—one that runs straight through Indian Customs. Imported printed photographs (HS Code 49119100) attract a tri-layer tax structure that surprises many first-time buyers. This guide unwraps each layer, shows you how to estimate the landed cost, and flags the paperwork that keeps your pictures from getting stuck in a bonded warehouse.

1. Finding the right tariff code

Printed photographs, art prints and posters all fall under Chapter 49 of the Customs Tariff. Within that chapter, “pictures, designs and photographs” are classified under HS Code 49119100. Getting the code right is crucial—mis-declaration can trigger penalties, delays or re-assessment at a higher rate.

Why the code matters

- It decides the Basic Customs Duty (BCD) rate.

- It locks in the applicable GST slab.

- It determines whether any exemptions (for example, for educational prints) exist.

2. The three-part duty cocktail

When your shipment lands, the assessing officer calculates duty in three distinct steps:

| Component | Statutory basis | Typical rate for HS 49119100 | Applies on |

|---|---|---|---|

| Basic Customs Duty (BCD) | Customs Tariff Act & Notification 50/2017 | 10% | CIF value* |

| Social Welfare Surcharge (SWS) | Sec. 110, Finance Act 2018 | 10% of BCD | BCD |

| Integrated GST (IGST) | IGST Act 2017 | 12% | CIF + BCD + SWS |

*CIF = Cost + Insurance + Freight declared on the Air Waybill.

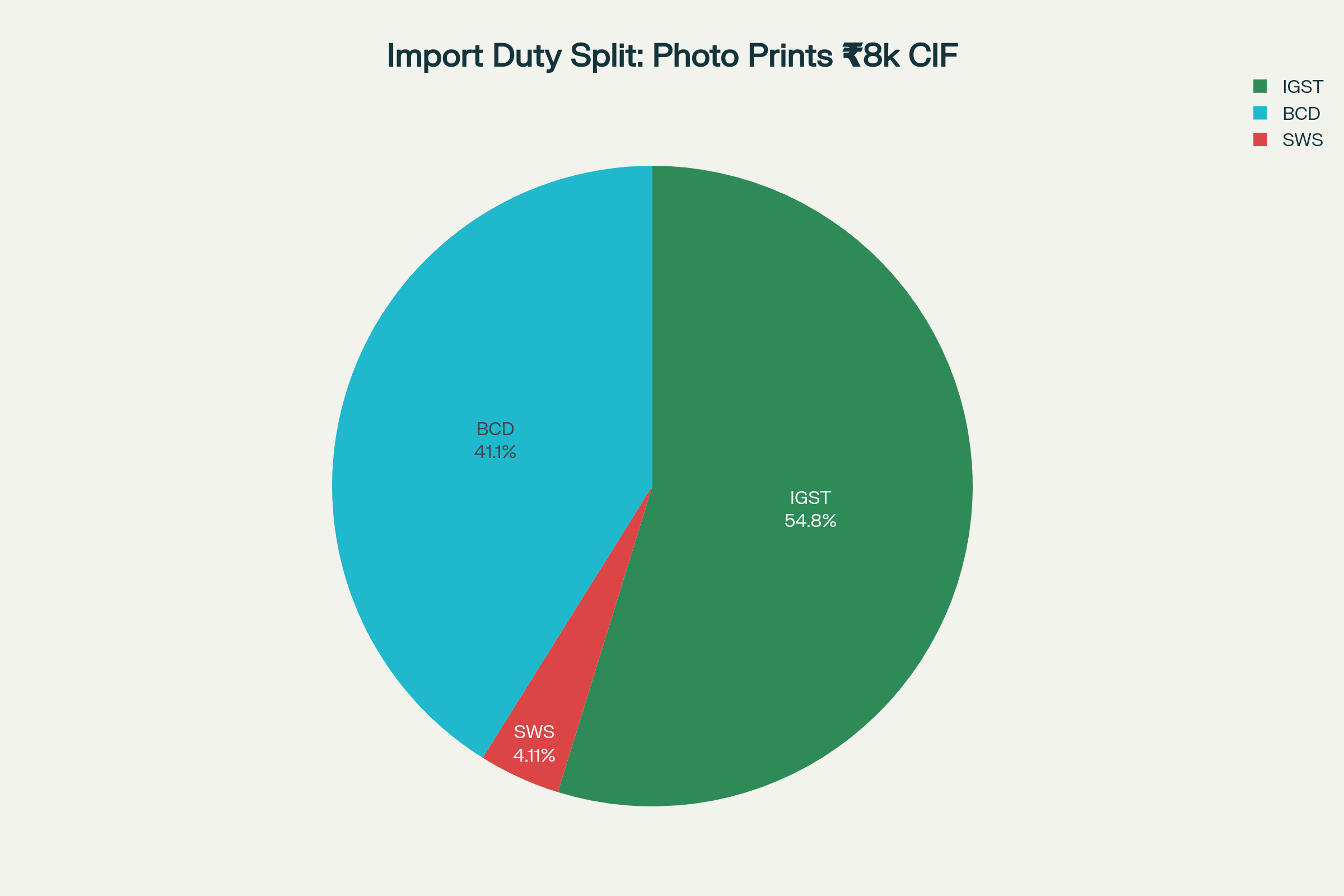

Worked example

Assume your photo prints cost ₹7,000, shipping and insurance add ₹1,000 (CIF ₹8,000).

- BCD = 10% of 8,000 = ₹800.

- SWS = 10% of 800 = ₹80.

- IGST = 12% of (8,000 + 800 + 80) = ₹1,065.60.

- Total duty payable = ₹1,945.60.

The chart shows that IGST forms the lion’s share because it is charged after adding the first two layers, a point many importers overlook.

3. Exemptions and small-value loopholes

3.1 Gift route (de minimis)

India allows duty-free import of bona-fide gifts valued up to ₹5,000 when sent by post or courier. Anything above that limit (or multiple parcels that appear split deliberately) is fully dutiable. Customs has tightened scrutiny after e-commerce misuse, so rely on this route sparingly.

3.2 Samples via courier

Under the Courier Imports Regulations, commercial samples or prototypes up to ₹10,000 can enter duty-free. Declare “PHOTO SAMPLE—NO COMMERCIAL VALUE” on the invoice, but be ready to show proof if asked.

3.3 Diplomatic & educational exemptions

Select educational, museum or diplomatic consignments qualify for total or partial exemption, but these require pre-approved Customs exemption certificates—not available to regular buyers.

4. Choosing the import channel

| Mode | Best for | Paperwork | Duty collection | Key limits |

|---|---|---|---|---|

| Regular air-cargo (CHA-handled) | Bulk gallery shipments | Bill of Entry (manual/e-SAGAR) | Paid before release | None |

| Registered courier (UPS, DHL, FedEx) | Small commercial orders | Courier Bill of Entry (CBE XI–XIV) | Courier pays, bills consignee | 70 kg per piece |

| India Post – Foreign Post Office | Single prints, gifts | Post Parcel list acts as Bill of Entry | Postman collects on delivery | 20 kg per parcel |

5. Documentation checklist

- Commercial invoice—state HS Code, print size, medium, quantity and true transaction value.

- Packing list—helps identify multiple SKUs.

- Air Waybill or Tracking ID—courier generates this.

- Import Export Code (IEC)—mandatory for businesses, optional for private individuals below the ₹50,000 IGST input credit threshold.

- Bill of Entry (BoE/CBE)—generated electronically by your courier; download it from ICEGATE to claim IGST credit21.

- GSTIN—quote your number if you plan to offset IGST as input tax.

Missing or ambiguous paperwork is the single biggest cause of detention at Indian ports, often incurring hefty demurrage.

6. Claiming input tax credit on IGST

For registered photographers and studios, IGST paid on import reflects automatically in GSTR-2A/2B after the Bill of Entry is filed21. You can use this credit to offset output GST on local sales of prints. Basic Customs Duty and SWS, however, remain sunk costs—neither creditable nor refundable.

7. Practical hacks to keep costs down

- Batch your orders—BCD is ad-valorem; combining multiple prints in one shipment does not increase the percentage, only the base.

- Use matte or semi-gloss—glass-framed prints shift classification to Chapter 83 (picture frames) with 15% BCD; ship frames separately if possible.

- Opt for postal parcels—slower but often assessed on conservative valuation, saving on IGST for low-value personal prints.

- Maintain proof of payment—PayPal receipts, credit-card statements and print-lab quotations help defend declared value during assessment.

- Register as SEZ/EPCG exporter—if you re-export mounted prints, duty can be suspended or rebated under Section 69, but paperwork is heavy.

8. Conclusion

Indian Customs does not treat photography as a duty-free art form. A simple 10 × 12-inch print can attract nearly 25% landed charges once BCD, SWS and IGST stack up. Understanding the HS code, declaring accurate values, and choosing the right channel can shave costs and prevent heart-stopping calls from the courier terminal. With clear paperwork and realistic budgeting, your imported photographs will move from tarmac to gallery wall without drama.